Essay

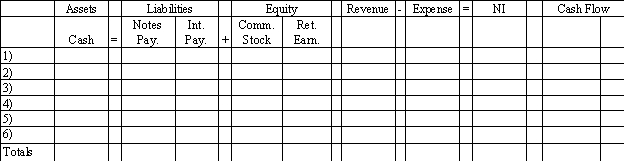

Osage Corporation began business operations and experienced the following transactions during 2016:

1)Issued common stock for $25,000 cash.

2)Issued a $20,000,6% 4-year note to the bank on February 1.

3)Provided services to customers for $80,000 cash.

4)Paid $38,000 for operating expenses.

5)Accrued interest expense on the note.

6)Paid a $4,000 dividend to shareholders.

Required:

Record the above transactions on a horizontal statements model to reflect their effect on Osage's financial statements.Precede the amount with a minus sign if the transaction reduces that section of the equation.Enter 0 for items not affected.Precede a cash outflow amount with a minus sign.In the last column,enter OA,IA,FA for the type of cash flow activity,or NA if there is no activity.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: The entry to recognize depreciation expense incurred

Q44: Two of the steps in the accounting

Q51: Which of the following is a claims

Q79: The term "recognition" means to report an

Q139: Which of the following financial statement elements

Q140: Which of the following choices accurately reflects

Q141: The following transactions apply to Kellogg Company.<br>1)Issued

Q145: Which of the following correctly states the

Q146: The recognition of an expense may be

Q149: Vanguard Company uses accrual accounting.Indicate whether each