Essay

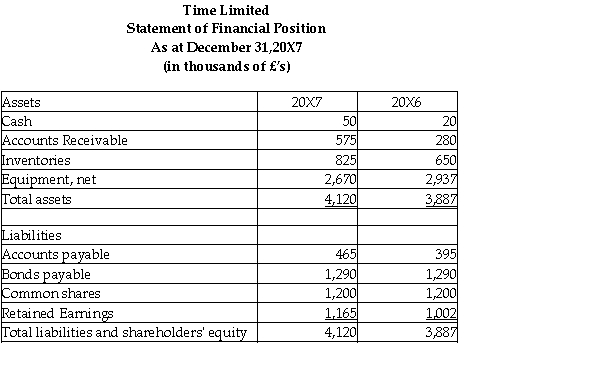

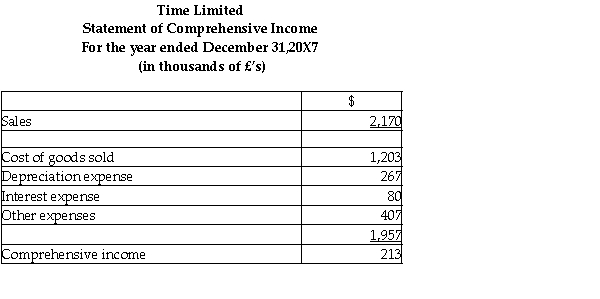

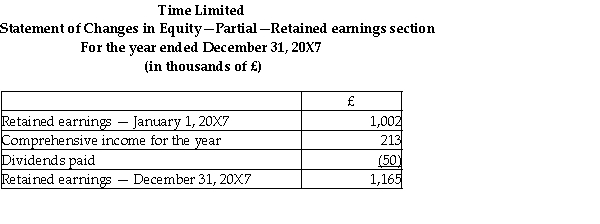

On January 1,20X7,Clock Inc.of Vancouver,British Columbia,purchased 75% of the outstanding shares of Time Limited,in London England.Time Limited's statements of financial position,statements of comprehensive income and changes in equity - retained earnings section for the year ended December 31,20X7 are below.

Additional information:

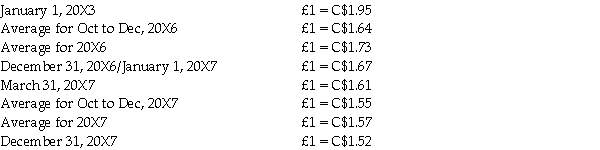

1.Time was incorporated on January 1,20X3 when it acquired all its equipment for £4,005,000 and issued its 10 year bonds payable.

2.Time's purchases and sales occurred evenly over the year.Inventories on hand at December 31,20X6 and December 20X7 were purchased evenly over the last quarter of 20X6 and 20X7,respectively.Inventories as at December 31,20X7 were £650,000.

3.Dividends were paid on March 31,20X7.

4.Foreign exchanges rates are as follows:

Required:

Translate Time's statement of comprehensive income for the year ended December 31,20X7 into Canadian dollars assuming its functional currency is Canadian dollars.Calculate the translation gain or loss arising in 20X7.

Correct Answer:

Verified

Calculation of translation ga...

Calculation of translation ga...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Which of the following accounts would be

Q32: IQ has a wholly owned subsidiary in

Q33: All of the following statements are stated

Q35: All of the following statements are stated

Q36: DNA was incorporated on January 2,20X0 and

Q36: Which of the following factors is a

Q37: All of the following statements are stated

Q38: All of the following statements are stated

Q39: When it is not clear what the

Q43: DNA was incorporated on January 2,20X0 and