Essay

DNA was incorporated on January 2,20X0 and commenced active operations immediately.Common shares were issued on the date of incorporation and no new common shares have been issued since then.On December 31,20X3,INT purchased 70% of the outstanding common shares of DNA for 800,000 Swiss francs (CHF).

DNA's main operations are located in Switzerland.For the year ending December 31,20X6,the income statement (in 000s)for DNA was as follows:

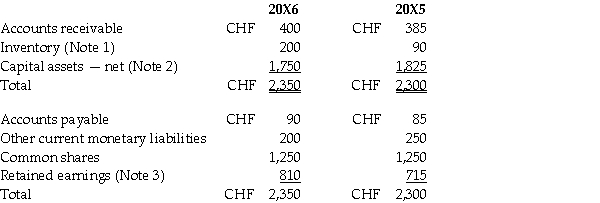

The comparative and condensed statements of financial position (in 000s)for DNA were as follows:

OTHER INFORMATION:

• Purchases and sales of merchandise inventory occurred evenly throughout the year.

• The ending inventory was purchased evenly throughout the last month of the year.

• DNA had purchased the capital assets on hand at the end of 20X6 on March 17,20X1.There were no purchases or sales of capital assets from 20X3 to 20X6.

• Dividends were paid on June 30,20X6.

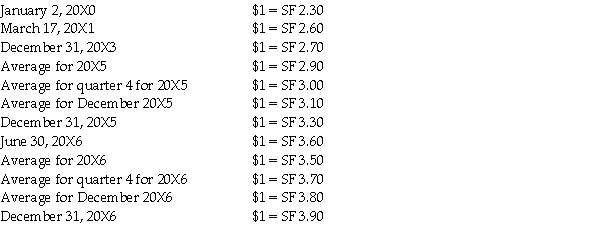

Assume that foreign exchange rates were as follows:

DNA's financial statements need to be translated into Canadian dollars for consolidation with INT's financial statements.

Required:

Calculate the exchange gain/loss on current monetary items for 20X6 under the temporal method.

Correct Answer:

Verified

Note 1: The Canadian dollar a...

Note 1: The Canadian dollar a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Which of the following accounts would be

Q32: IQ has a wholly owned subsidiary in

Q33: All of the following statements are stated

Q35: All of the following statements are stated

Q36: Which of the following factors is a

Q36: DNA was incorporated on January 2,20X0 and

Q37: All of the following statements are stated

Q38: All of the following statements are stated

Q39: When it is not clear what the

Q41: On January 1,20X7,Clock Inc.of Vancouver,British Columbia,purchased 75%