Multiple Choice

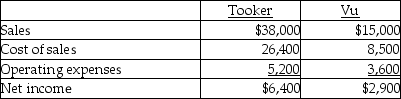

Tooker Co.acquired 80% of the outstanding common shares of Vu Ltd.There were no fair value increments or goodwill that arose with the purchase.During 20X1,Tooker sold $7,000 of inventory to Vu for a gross profit of 40%.At the end of 20X1,$3,000 of the inventory is still in Vu's inventory.On their single-entity income statements for 20X1,Tooker and Vu reported the following:

Vu sold all the goods from Tooker that were in its opening inventory.There were no sales between Tooker and Vu in 20X2.What is the non-controlling interest's share of consolidated net income at the end of 20X2?

A) $580

B) $1,620

C) $1,860

D) $2,100

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Arnez Ltd. acquired 70% of the outstanding

Q27: Tooker Co.acquired 80% of the outstanding common

Q28: On September 1,20X5,Hot Limited decided to buy

Q29: Fox owns 60% of the outstanding common

Q30: Mallard Ltd.acquired 75% of the outstanding common

Q31: Bowen Limited purchased 60% of Sloch Co.when

Q32: Farm owns 70% of the common shares

Q33: On September 1,20X5,Hot Limited decided to buy

Q34: Cooper Ltd.acquired 70% of the common shares

Q36: Fort owns 70% of the outstanding common