Multiple Choice

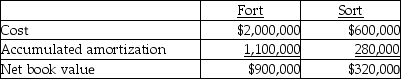

Fort owns 70% of the outstanding common shares of Sort.On December 30,20X3,Sort sold some equipment to Fort for $100,000.The equipment had been purchased by Sort for $120,000 in 20X2,had accumulated amortization of $30,000 and a six-year remaining life at December 31,20X3.Both companies record a full year of amortization expense for assets purchased in the first half of the year and no amortization on assets purchased in the last half of the year.Equipment for Fort and Sort on their separate-entity balance sheets at December 31,20X3 was as follows:

On December 31,20X6,Fort sold the equipment to an outside company for $65,000.What is the gain on sale of equipment to be reported on the consolidated income statement for the year ended December 31,20X6?

A) $10,500

B) $14,000

C) $15,000

D) $20,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Arnez Ltd. acquired 70% of the outstanding

Q27: Tooker Co.acquired 80% of the outstanding common

Q28: On September 1,20X5,Hot Limited decided to buy

Q29: Fox owns 60% of the outstanding common

Q30: Mallard Ltd.acquired 75% of the outstanding common

Q31: Bowen Limited purchased 60% of Sloch Co.when

Q32: Farm owns 70% of the common shares

Q33: On September 1,20X5,Hot Limited decided to buy

Q34: Cooper Ltd.acquired 70% of the common shares

Q35: Tooker Co.acquired 80% of the outstanding common