Multiple Choice

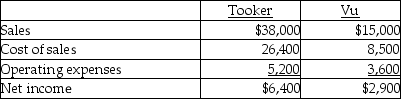

Tooker Co.acquired 80% of the outstanding common shares of Vu Ltd.There were no fair value increments or goodwill that arose with the purchase.During 20X1,Tooker sold $7,000 of inventory to Vu for a gross profit of 40%.At the end of 20X1,$3,000 of the inventory is still in Vu's inventory.On their single-entity income statements for 20X1,Tooker and Vu reported the following:

Vu sold all the goods from Tooker that were in its opening inventory.There were no sales between Tooker and Vu in 20X2.At the end of 20X2,what portion of consolidated net income is attributable to Tooker?

A) $8,400

B) $9,300

C) $9,920

D) $10,500

Correct Answer:

Verified

Correct Answer:

Verified

Q10: On January 2,20X5,Ross Co.acquired 90% of Singh

Q10: Pal Co. owns 70% of the outstanding

Q12: Linville Ltd.owns 80% of the outstanding shares

Q13: On January 1,20X5,PX's shareholders' equity was as

Q14: Fox owns 60% of the outstanding common

Q16: TLC Homecare Ltd.owns 100% of Errand Service

Q17: Prawn Corporation owns 80 percent of the

Q19: Prawn Corporation owns 80 percent of the

Q22: Mallard Ltd. acquired 75% of the outstanding

Q28: Roslynn Ltd. is a subsidiary of Goodale