Essay

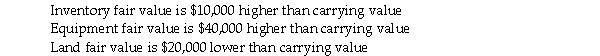

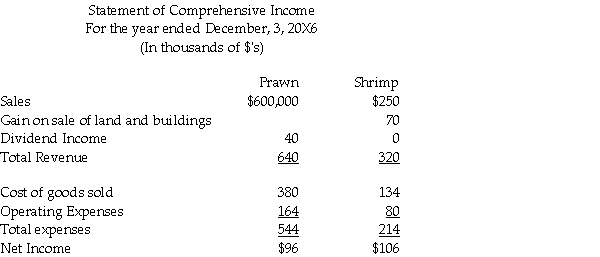

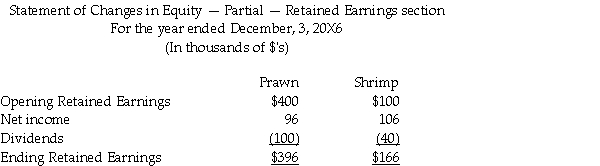

Prawn Corporation owns 80 percent of the outstanding voting shares of Shrimp Corporation,having acquired its interest January 1,20X3 for $100,000.At the time of the acquisition,Shrimp Corporation had a shareholder's equity totalling $150,made up for retained earnings of $30,000 and common shares of $20,000.The following accounts had fair values higher (or lower)than its carrying values:

The equipment had a remaining useful life at the time of acquisition of five years.

The company uses the entity approach to determine the amount of goodwill.

The balance of the land and buildings at December 31,20X6 for Prawn totalled $895,000 and for Shrimp totalled $450,000.

Additional Information:

1.Shrimp had reported $50,000,relating to land (40%)and building (60%)sold to Prawn on January 3,20X5.These separate properties had not been owned on January 1,20X3.Remaining useful life was expected to be 10 years at that time.

2.Shrimp sold other land to a non-related company at a gain of $20,000 on June 30,20X6.

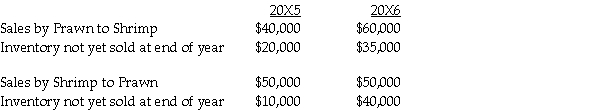

3.Intercompany sales and inventory data for 20X5 and 20X6:

Profit margins on sales by Prawn to Shrimp are 40%.

Profit margins on sales by Shrimp to Prawn are at 30%.

Required:

Calculate the following consolidated balance as at December 31,20X6:

a.Retained earnings

b.Land and Buildings

Correct Answer:

Verified

Calculation of goodwill at dat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Pal Co. owns 70% of the outstanding

Q12: Linville Ltd.owns 80% of the outstanding shares

Q13: On January 1,20X5,PX's shareholders' equity was as

Q14: Fox owns 60% of the outstanding common

Q15: Tooker Co.acquired 80% of the outstanding common

Q16: TLC Homecare Ltd.owns 100% of Errand Service

Q19: Prawn Corporation owns 80 percent of the

Q19: Chandler Ltd. owns 65% of Stork Co.

Q21: Lobes Co.owns 65% of Banes Limited.During 20X5,Banes

Q22: Mallard Ltd. acquired 75% of the outstanding