Multiple Choice

Clark Manufacturing makes blank CDs; it is a very competitive market and the company follows a target pricing strategy. Currently the market price for a unit of product (one unit equals a package of 100 CDs) is $18.00. Clark's production costs are shown below:

Direct materials $5.00 per unit

Direct labor $2.90 per unit

Indirect production costs $6.42 per unit

Non-manufacturing costs $3.20 per unit

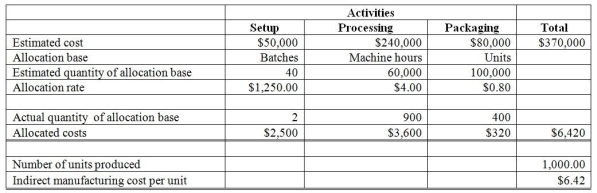

Clark uses activity-based costing for its indirect production costs and provides the following information about this particular product:

-

The company's objective is to earn 5% profit on the sales price of the product. Clark carried out a value engineering study and decided that they could make the processing activity more efficient and save costs. In order to achieve their profit objective for this product, they need to reduce the indirect cost per unit from $6.42 down to what amount?

A) $6.10

B) $6.00

C) $5.80

D) $5.62

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following would most likely

Q129: Pollenti Company has just merged with another

Q130: Johnson Production Company uses just-in-time production

Q131: Johnson Production Company uses just-in-time production and

Q132: Full-product cost includes both manufacturing and non-manufacturing

Q133: Which of the following categories includes costs

Q136: Pitt Jones Company had the following

Q137: Johnson Production Company uses just-in-time production

Q138: Clark Manufacturing makes blank CDs; it is

Q139: Two main benefits of activity-based costing are