Multiple Choice

Clark Manufacturing makes blank CDs; it is a very competitive market and the company follows a target pricing strategy. Currently the market price for a unit of product (one unit equals a package of 100 CDs) is $18.00. Clark's production costs are shown below:

Direct materials $5.00 per unit

Direct labor $2.90 per unit

Indirect production costs $6.42 per unit

Non-manufacturing costs $3.20 per unit

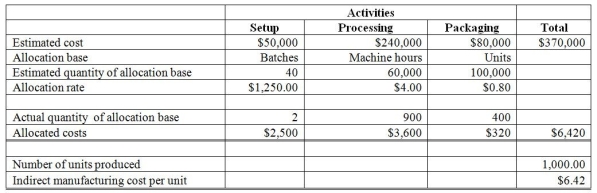

Clark uses activity-based costing for its indirect production costs and provides the following information about this particular product:

-

The company's objective is to earn 5% profit on the sales price of the product. Clark carried out a value engineering study and decided that they could make the processing activity more efficient and save costs. If they reduce the total processing activity cost by $20,000, what will their profit percentage be? (Please round to the nearest tenth of a percent.)

A) 4.3%

B) 4.9%

C) 5.9%

D) 5.2%

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following would most likely

Q133: Which of the following categories includes costs

Q134: Clark Manufacturing makes blank CDs; it is

Q136: Pitt Jones Company had the following

Q137: Johnson Production Company uses just-in-time production

Q139: Two main benefits of activity-based costing are

Q140: The cost of inspection at various stages

Q141: In a just-in-time costing system, the entry

Q142: Percival Company wishes to sell wooden beams

Q143: Orlando Avionics makes three types of