Multiple Choice

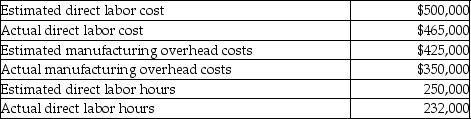

Federer Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for allocating manufacturing overhead.The following information is available for the most recent year:

If Federer Company uses direct labor hours as the allocation base,what would the allocated manufacturing overhead be for the year?

A) $425,000

B) $350,000

C) $394,400

D) $324,800

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Companies should always use job costing rather

Q104: Twinkle Ornaments Company uses job costing.Twinkle Ornaments

Q105: Calculate the unknowns for the following independent

Q107: Here is selected data for Lori Corporation:<br><img

Q110: Wet N Wild Sports Equipment Company's work

Q111: Guys and Dolls Corporation uses job costing.The

Q112: For a manufacturer that uses job costing,show

Q114: Serena Corporation uses estimated manufacturing overhead costs

Q250: The law firm of Lyons & Lyons

Q314: Which of the following would be an