Essay

Calculate the unknowns for the following independent situations.

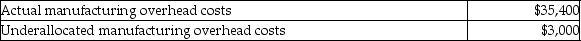

1.Selected data for Lion Corporation:

Allocated manufacturing overhead is based on 50% of direct labor cost.

a.Calculate the allocated manufacturing overhead cost.

b.Calculate the direct labor cost.

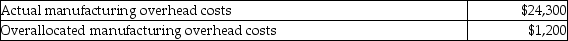

2.Selected data for Tiger Corporation:

Manufacturing overhead is allocated at $15 per machine hour.

a.Calculate the allocated manufacturing overhead cost.

b.Calculate the number of machine hours incurred.

Correct Answer:

Verified

Correct Answer:

Verified

Q95: At a manufacturing company, inventory flows from

Q100: Here are selected data for Sally Day

Q101: Wet N Wild Sports Equipment Company's work

Q104: Twinkle Ornaments Company uses job costing.Twinkle Ornaments

Q107: Here is selected data for Lori Corporation:<br><img

Q109: Federer Company is debating the use of

Q110: Wet N Wild Sports Equipment Company's work

Q199: The entry to transfer sold goods includes

Q250: The law firm of Lyons & Lyons

Q314: Which of the following would be an