Multiple Choice

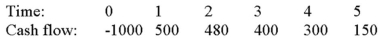

Compute the discounted payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent and the maximum allowable discounted payback is three years.

A) 2.49 years, accept

B) 2.98 years, accept

C) 3.49 years, reject

D) 4.98 years, reject

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Suppose your firm is considering investing in

Q45: Compute the payback statistic for Project Y

Q46: Suppose your firm is considering investing in

Q51: Suppose your firm is considering two mutually

Q52: Suppose your firm is considering two independent

Q53: For a project with normal cash flows,what

Q55: Which of the following tools is suitable

Q83: A project has normal cash flows. Its

Q84: A capital budgeting technique that generates a

Q121: Which of these are sets of cash