Multiple Choice

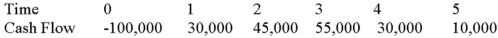

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

A) 1.23 years, accept

B) 2.45 years, accept

C) 2.77 years, accept

D) 5.36 years, reject

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Suppose your firm is considering investing in

Q45: Compute the payback statistic for Project Y

Q48: Compute the discounted payback statistic for Project

Q51: Suppose your firm is considering two mutually

Q55: Which of the following tools is suitable

Q58: Which of the following statements is correct

Q75: The benchmark for the profitability index (PI)

Q83: A project has normal cash flows. Its

Q84: A capital budgeting technique that generates a

Q121: Which of these are sets of cash