Multiple Choice

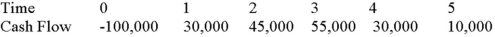

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

A) $35,995.86, reject

B) $38,875.53, accept

C) $138,875.53, accept

D) $238,875.53, accept

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is a capital

Q13: Suppose your firm is considering investing in

Q14: Suppose your firm is considering investing in

Q15: Compute the discounted payback statistic for Project

Q16: Suppose your firm is considering investing in

Q17: Suppose your firm is considering investing in

Q19: Suppose your firm is considering investing in

Q20: Suppose your firm is considering two mutually

Q28: The least-used capital budgeting technique in industry

Q73: Neither payback period nor discounted payback period