Multiple Choice

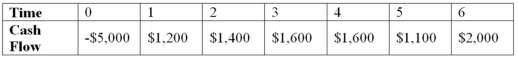

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years,respectively.Use the IRR decision to evaluate this project; should it be accepted or rejected?

A) IRR = 16.92 percent; accept the project

B) IRR = 7.123 percent; reject the project

C) IRR = 18.32 percent; accept the project

D) IRR = 7.59 percent; reject the project

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is a capital

Q12: Suppose your firm is considering two independent

Q13: Suppose your firm is considering investing in

Q14: Suppose your firm is considering investing in

Q15: Compute the discounted payback statistic for Project

Q16: Suppose your firm is considering investing in

Q18: Suppose your firm is considering investing in

Q19: Suppose your firm is considering investing in

Q20: Suppose your firm is considering two mutually

Q28: The least-used capital budgeting technique in industry