Multiple Choice

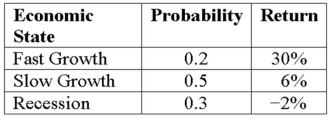

Expected Return Risk Compute the standard deviation of the expected return given these three economic states,their likelihoods,and the potential returns:

A) 8.4 percent

B) 10.87 percent

C) 11.34 percent

D) 24.09 percent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q21: Which of the following is incorrect?<br>A)Technical analysis

Q23: Under/Over-Valued Stock A manager believes his firm

Q24: You hold the positions in the following

Q28: Which of the following is typically considered

Q28: What is required to use the constant-growth

Q29: How can one account for movements in

Q30: Explain the security market line's equation.

Q31: Portfolio Beta You have a portfolio with

Q74: A manager believes his firm will earn

Q78: The constant growth model assumes which of