Multiple Choice

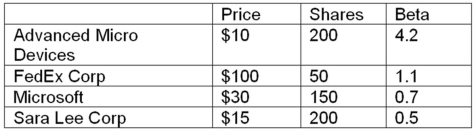

You hold the positions in the following table.What is the beta of your portfolio? If you expect the market to earn 10 percent and the risk-free rate is 4 percent,what is the required return of the portfolio?

A) 12.37 percent

B) 9.73 percent

C) 10.17 percent

D) 11.68 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Which of the following is most correct?<br>A)In

Q21: Which of the following is incorrect?<br>A)Technical analysis

Q23: Under/Over-Valued Stock A manager believes his firm

Q26: Expected Return Risk Compute the standard deviation

Q28: Which of the following is typically considered

Q28: What is required to use the constant-growth

Q29: How can one account for movements in

Q48: Which of the following is the use

Q74: A manager believes his firm will earn

Q78: The constant growth model assumes which of