Multiple Choice

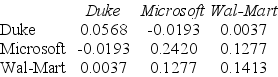

Use the table for the question(s) below.

Consider the following covariances between securities:

-Which of the following formulas is INCORRECT?

A) Variance of an equally Weighted Portfolio = (1 -  ) (Average Variance of Individual Stocks) +

) (Average Variance of Individual Stocks) + (Average covariance between the stocks)

(Average covariance between the stocks)

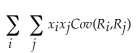

B) Variance of a portfolio =

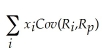

C) Variance of a portfolio =

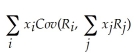

D) Variance of a portfolio =

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following statements is FALSE?<br>A)

Q8: Use the information for the question(s)below.<br>Suppose that

Q10: Suppose that Google Stock has a beta

Q12: Use the table for the question(s)below.<br>Consider the

Q69: Use the table for the question(s)below.<br>Consider the

Q74: Use the table for the question(s)below.<br>Consider the

Q82: Use the information for the question(s)below.<br>Suppose that

Q84: Which of the following statements is FALSE?<br>A)Because

Q109: Use the following information to answer the

Q116: Use the information for the question(s)below.<br>Tom's portfolio