Multiple Choice

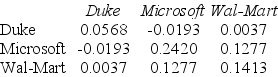

Use the table for the question(s) below.

Consider the following covariances between securities:

-Which of the following formulas is INCORRECT?

A) Variance of an equally Weighted Portfolio = (1 -  ) (Average Variance of Individual Stocks) +

) (Average Variance of Individual Stocks) + (Average covariance between the stocks)

(Average covariance between the stocks)

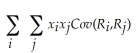

B) Variance of a portfolio =

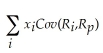

C) Variance of a portfolio =

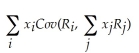

D) Variance of a portfolio =

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The beta for the risk-free investment is

Q25: Use the table for the question(s)below.<br>Consider the

Q31: Use the table for the question(s)below.<br>Consider the

Q34: Use the information for the question(s)below.<br>Tom's portfolio

Q41: Which of the following statements is FALSE?<br>A)To

Q69: Use the table for the question(s)below.<br>Consider the

Q71: Suppose you invest $15,000 in Merck stock

Q105: Use the table for the question(s)below.<br>Consider the

Q122: Use the following information to answer the

Q124: Use the information for the question(s)below.<br>Suppose that