Multiple Choice

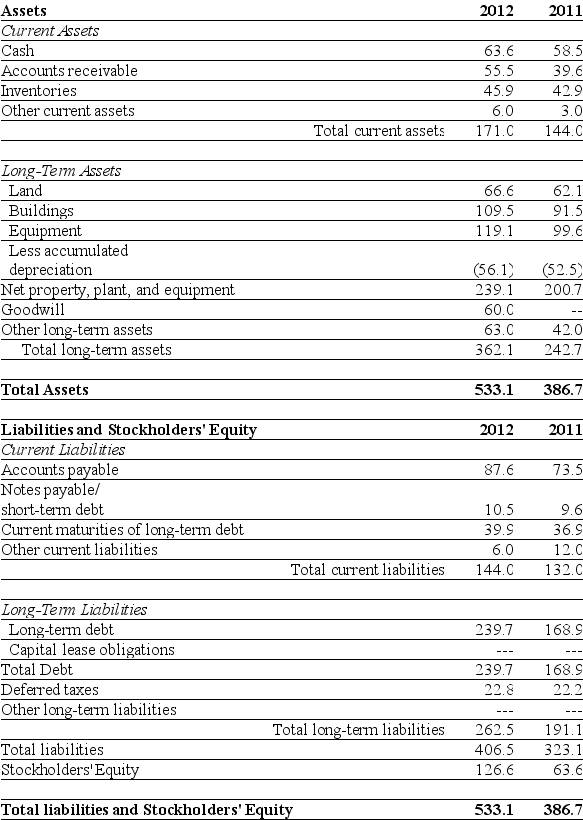

Use the table for the question(s) below.

Consider the following balance sheet:

-Luther Corporation's stock price is $39 and the company has 20 million shares outstanding. Its book value Debt -Equity Ratio for 2012 is closest to:

A) 2.29

B) 0.31

C) 1.89

D) 0.37

Correct Answer:

Verified

Correct Answer:

Verified

Q3: In the US the Dodd-Frank Wall Street

Q5: If Firm A and Firm B are

Q5: If on December 31, 2011 Luther has

Q6: Use the table for the question(s)below.<br>Consider the

Q7: Use the following information for ECE incorporated:<br>Assets

Q10: Use the table for the question(s)below.<br>Consider the

Q13: What are the four financial statements that

Q35: Use the following information for ECE incorporated:<br><img

Q42: If Moon Corporation has an increase in

Q81: The firm's revenues and expenses over a