Multiple Choice

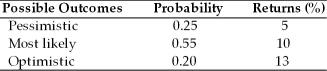

The expected value, standard deviation of returns, and coefficient of variation for asset A are (See below.) Asset A

A) 10 percent, 8 percent, and 1.25, respectively.

B) 9.33 percent, 8 percent, and 2.15, respectively.

C) 9.35 percent, 4.68 percent, and 2.00, respectively.

D) 9.35 percent, 2.76 percent, and 0.295, respectively.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Liquidity risk is the chance that changes

Q4: Perry purchased 100 shares of Ferro, Inc.

Q6: The lower the coefficient of variation, the

Q8: Table 8.3<br>Consider the following two securities X

Q9: An increase in the beta of a

Q16: A given change in inflationary expectations will

Q49: The more certain the return from an

Q75: A change in inflationary expectations resulting from

Q123: Combining uncorrelated assets can reduce risk-not as

Q178: In general, the lower the correlation between