Essay

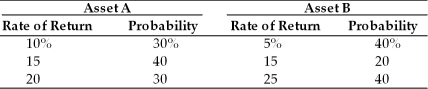

Champion Breweries must choose between two asset purchases. The annual rate of return and related probabilities given below summarize the firm's analysis.  For each asset, compute

For each asset, compute

(a) the expected rate of return.

(b) the standard deviation of the expected return.

(c) the coefficient of variation of the return.

(d) Which asset should Champion select?

Correct Answer:

Verified

(a)  Expected Return = 15% Expected Retu...

Expected Return = 15% Expected Retu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A portfolio combining two assets with less

Q50: Most managers are risk-averse, since for a

Q98: Table 8.3<br>Consider the following two securities X

Q99: For the risk-averse manager, required return would

Q104: A portfolio that combines two assets having

Q105: An increase in nondiversifiable risk<br>A) would cause

Q106: _ risk represents the portion of an

Q122: Tim purchased a bounce house one year

Q150: Combining negatively correlated assets having the same

Q185: A normal probability distribution is an asymmetrical