Multiple Choice

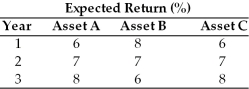

Table 8.1

-The correlation of returns between Asset A and Asset B can be characterized as ________. (See Table 8.1)

A) perfectly positively correlated

B) perfectly negatively correlated

C) uncorrelated

D) cannot be determined

Correct Answer:

Verified

Correct Answer:

Verified

Q30: An increase in the Treasury Bill rate

Q31: The standard deviation of a portfolio is

Q32: Tangshan Antiques has a beta of 1.40,

Q33: Two assets whose returns move in the

Q35: Systematic risk is also referred to as<br>A)

Q38: Table 8.2<br>You are going to invest $20,000

Q63: A beta coefficient of 0 represents an

Q92: A portfolio of two negatively correlated assets

Q117: Table 8.1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt="Table 8.1

Q170: The capital asset pricing model (CAPM) links