Multiple Choice

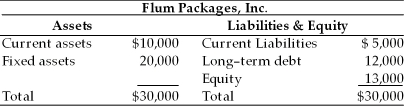

Table 15.2  The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

-If the firm was to shift $7,000 of fixed assets to current assets, the firm's net working capital would ________, the annual profits on total assets would ________, and the risk of not being able to meet current obligations would ________, respectively. (See Table 15.2)

A) increase; decrease; increase

B) decrease; increase; decrease

C) increase; decrease; decrease

D) decrease; increase; increase

Correct Answer:

Verified

Correct Answer:

Verified

Q82: Playing the float involves the strategic use

Q156: Because managing inventory is just like managing

Q172: Table 15.3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2927/.jpg" alt="Table 15.3

Q176: All of the following managers would like

Q178: Table 15.4<br>Bowring Ball Bearings has 10 different

Q179: An increase in accounts receivable turnover due

Q180: A customer sends payment to a post

Q181: With the ACH (automated clearing house) credits,

Q304: Federal agency issues are low-risk securities issued

Q318: Table 15.1<br>Irish Air Services has determined several