Multiple Choice

Table 12.1

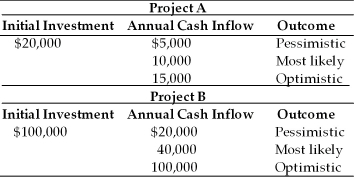

A corporation is assessing the risk of two capital budgeting proposals. The financial analysts have developed pessimistic, most likely, and optimistic estimates of the annual cash inflows which are given in the following table. The firm's cost of capital is 10 percent.

-The expected net present value of project A if the outcomes are equally probable and the project has five-year life is ________. (See Table 12.1)

A) -$1,045

B) $17,910

C) $36,865

D) $93,730

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The three basic types of risk associated

Q9: Real options are opportunities that are embedded

Q16: The break even cash inflow is the

Q51: In selecting the best group of unequal-lived

Q83: A firm is evaluating two mutually exclusive

Q84: Behavioral approaches for dealing with risk include

Q85: In international capital budgeting decisions, political risks

Q89: Table 12.1<br>A corporation is assessing the risk

Q90: In selecting the best group of unequal-lived

Q91: Major types of real options include all