Essay

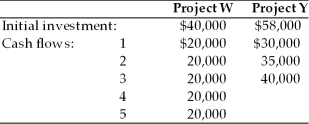

A firm is evaluating two mutually exclusive projects that have unequal lives. The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select. The firm's cost of capital has been determined to be 18 percent, and the projects have the following initial investments and cash flows:

Correct Answer:

Verified

ANPV of Project W: $22,540/3....

ANPV of Project W: $22,540/3....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: The three basic types of risk associated

Q9: Real options are opportunities that are embedded

Q16: The break even cash inflow is the

Q51: In selecting the best group of unequal-lived

Q79: The preferred approach for risk adjustment of

Q80: Table 12.6<br>Yong Importers, an Asian import company,

Q84: Behavioral approaches for dealing with risk include

Q85: In international capital budgeting decisions, political risks

Q86: Table 12.1<br>A corporation is assessing the risk

Q88: Simulation is an approach that evaluates the