Multiple Choice

Table 12.6

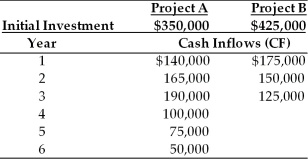

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-The NPVs of projects A and B are ________. (See Table 12.6)

A) $95,066 and $56,386, respectively

B) $56,386 and $95,066, respectively

C) -$56,386 and -$95,066, respectively

D) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Table 12.5<br>Nico Manufacturing is considering investment in

Q36: Table 12.6<br>Yong Importers, an Asian import company,

Q37: Tangshan Mining Company, with a cost of

Q38: Risk-adjusted discount rates (RADRs) are the risk-adjustment

Q42: The importance and widespread use of transfer

Q43: Sensitivity analysis is a statistically based approach

Q44: Table 12.3<br>Tangshan Mining Company is considering investment

Q45: Behavioral approaches for dealing with project risk<br>A)

Q55: The higher the risk of a project,

Q73: Because of the basic mathematics of compounding