Multiple Choice

Table 12.6

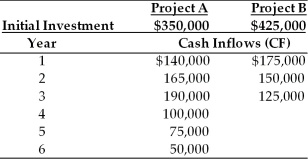

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-Which project should be chosen on the basis of the normal NPV approach? (See Table 12.6)

A) Project A

B) Project B

C) neither

D) both

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Table 12.5<br>Nico Manufacturing is considering investment in

Q31: Scenario analysis is a behavioral approach that

Q32: In a capital budgeting context, risk is

Q34: Table 12.2<br>A firm is considering investment in

Q36: Table 12.5<br>Nico Manufacturing is considering investment in

Q37: Tangshan Mining Company, with a cost of

Q38: Risk-adjusted discount rates (RADRs) are the risk-adjustment

Q40: Table 12.6<br>Yong Importers, an Asian import company,

Q55: The higher the risk of a project,

Q73: Because of the basic mathematics of compounding