Multiple Choice

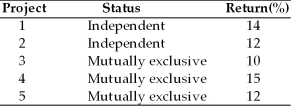

A firm with unlimited funds must evaluate five projects. Projects 1 and 2 are independent and Projects 3, 4, and 5 are mutually exclusive. The projects are listed with their returns.  A ranking of the projects on the basis of their returns from the best to the worst according to their acceptability to the firm would be

A ranking of the projects on the basis of their returns from the best to the worst according to their acceptability to the firm would be

A) 4, 1, 2 or 5, and 3.

B) 4, 1, and 2.

C) 3, 2 or 5, 1, and 4.

D) 4, 1, 5, and 3.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: In applying risk-adjusted discount rates to project

Q9: Real options are opportunities that are embedded

Q10: In applying risk-adjusted discount rates to project

Q16: The break even cash inflow is the

Q73: Because of their focus on total risk,

Q75: If a firm has a limited capital

Q79: The preferred approach for risk adjustment of

Q80: Table 12.6<br>Yong Importers, an Asian import company,

Q86: Table 12.2<br>A firm is considering investment in

Q88: Simulation is an approach that evaluates the