Essay

Table 11.3

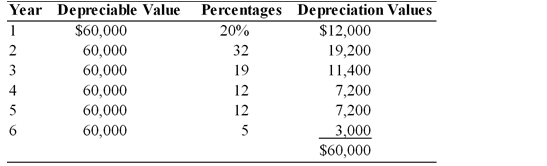

Fine Press is considering replacing the existing press with a more efficient press. The new press costs $55,000 and requires $5,000 in installation costs. The old press was purchased 2 years ago for an installed cost of $35,000 and can be sold for $20,000 net of any removal costs today. Both presses are depreciated under the MACRS 5-year recovery schedule. The firm is in 40 percent marginal tax rate.

-Calculate the initial investment of the new asset. (See Table 11.3)

Correct Answer:

Verified

Correct Answer:

Verified

Q8: In applying risk-adjusted discount rates to project

Q14: Table 11.4<br>Computer Disk Duplicators, Inc. has been

Q15: Table 11.12<br>Yong Importers, an Asian import company,

Q16: Table 11.7<br>A corporation is assessing the risk

Q23: The _ reflects the return that must

Q26: The risk-adjusted discount rate (RADR) is the

Q37: A market risk-return function is a graphical

Q59: Sunk costs are cash outlays that have

Q62: One type of simulation program made popular

Q94: Table 12.2<br>A firm is considering investment in