Multiple Choice

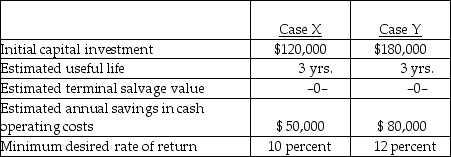

Below are two potential investment alternatives:

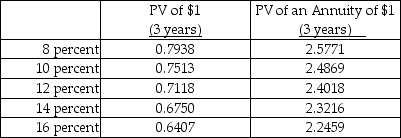

-Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case Y is

A) $80,000.

B) $12,144.

C) $(328) .

D) $123,056.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Alpha Company has the following information:<br> <img

Q34: The Chevette Company has come to you

Q35: The value that will accumulate by the

Q36: Depreciation deductions and similar deductions that protect

Q37: Use the following information to answer the

Q39: If a company pays taxes of 15

Q40: Capital expenditure models that identify criteria for

Q41: Cedric Inc. is considering two mutually exclusive

Q43: Below are two potential investment alternatives:<br> <img

Q74: The payback model measures profitability as well