Multiple Choice

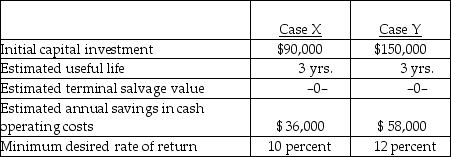

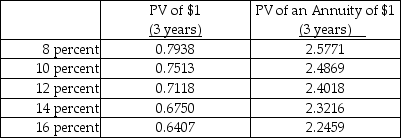

Below are two potential investment alternatives:

-Assume straight-line amortization in all computations, and ignore income taxes. The net present value in case A is

A) $54,000.

B) $( 472) .

C) $ 6,000.

D) $(6,000) .

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Below are two potential investment alternatives:<br> <img

Q39: If a company pays taxes of 15

Q40: Capital expenditure models that identify criteria for

Q41: Cedric Inc. is considering two mutually exclusive

Q44: The owner of a construction company is

Q45: DOCA Corp. is considering the following two

Q46: Below are two potential investment alternatives:<br> <img

Q47: Below are two potential investment alternatives:<br> <img

Q48: Beta Company has the following information:<br> <img

Q74: The payback model measures profitability as well