Multiple Choice

Fagen Grocery Store is considering the purchase of a new $45,000 delivery truck. The truck will have a useful life of 5 years, no terminal salvage value, and tax amortization will be calculated using the straight-line method.

If the truck is purchased, the company will be able to increase annual revenues by $90,000 per year for the life of the truck, but out-of-pocket expenses will also increase by $67,500 per year.

Assume a tax rate of 30 percent and a required after-tax rate of return equal to 10 percent.

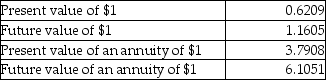

Time value factors are given below for 5 years and an interest rate of 10 percent.

-What is the net present value of the tax savings from depreciation?

A) $3,912

B) $23,881

C) $10,235

D) $1,677

Correct Answer:

Verified

Correct Answer:

Verified

Q94: Alpha Company has the following information:<br> <img

Q106: The rate of return that equates the

Q107: The Quast Company is considering a capital

Q108: The Serena Company is evaluating two mutually

Q109: Beta Company has the following information:<br> <img

Q110: Which of the following is not true

Q111: Fagen Grocery Store is considering the purchase

Q113: One purpose of a postaudit is to

Q114: Inflation is<br>A) not a factor in most

Q115: Boric Company is considering the purchase of