Essay

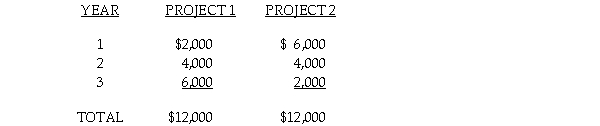

The Serena Company is evaluating two mutually exclusive projects with three-year lives. Each project requires an investment of $10,000. The projects have the following cash inflows received at the end of each year.  a. Determine the net present value of each project using an 8% discount rate.

a. Determine the net present value of each project using an 8% discount rate.

b. What can you conclude about the effect the timing of the cash flows has upon a project's net present value?

Correct Answer:

Verified

NPV of Project 1:  NPV of Proj...

NPV of Proj...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: The net present value model expresses all

Q104: A company is considering the purchase of

Q105: Which of the following methods determines the

Q106: The rate of return that equates the

Q107: The Quast Company is considering a capital

Q109: Beta Company has the following information:<br> <img

Q110: Which of the following is not true

Q111: Fagen Grocery Store is considering the purchase

Q112: Fagen Grocery Store is considering the purchase

Q113: One purpose of a postaudit is to