Multiple Choice

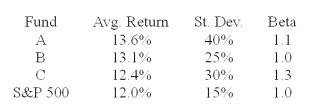

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%.

-You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation.The fund with the highest Sharpe measure of performance is __________.

A) Fund A

B) Fund B

C) Fund C

D) indeterminable

Correct Answer:

Verified

Correct Answer:

Verified

Q16: A passive benchmark portfolio is _.<br>I.a portfolio

Q17: Consider the theory of active portfolio management.Stocks

Q18: Stocks A and B have alphas of

Q19: The M<sup>2</sup> measure is a variant of

Q20: The correct measure of timing ability is

Q22: Suppose that over the same time period

Q23: A portfolio generates an annual return of

Q24: A fund has excess performance of 1.5%.In

Q25: Morningstar's RAR produce results which are similar

Q26: In a particular year, Salmon Arm Mutual