Multiple Choice

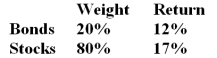

In a particular year, Salmon Arm Mutual Fund earned a return of 16% by making the following investments in asset classes:  The return on a bogey portfolio was 12% calculated as follows:

The return on a bogey portfolio was 12% calculated as follows:

-The total excess return on the managed portfolio was __________.

A) 2%

B) 3%

C) 4%

D) 5%

Correct Answer:

Verified

Correct Answer:

Verified

Q21: The average returns, standard deviations and betas

Q22: Suppose that over the same time period

Q23: A portfolio generates an annual return of

Q24: A fund has excess performance of 1.5%.In

Q25: Morningstar's RAR produce results which are similar

Q27: Consider the Sharpe and Treynor performance measures.When

Q28: Which one of the following performance measures

Q29: The table presents the actual return of

Q30: Henriksson found that,on average,betas of funds _

Q31: The table presents the actual return of