Multiple Choice

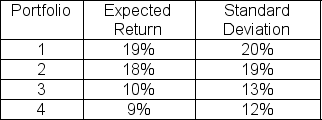

The expected return on the market is 12 percent with a standard deviation of 15 percent and the risk-free rate is 4.5 percent.Which of the following portfolios are overvalued?

A) 1 and 2 only

B) 1 and 4 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q75: Assume that the CAPM holds.If a security

Q76: Theoretically,what is meant by the market portfolio?<br>A)

Q78: Stock Z has a standard deviation of

Q79: What are the expected return and standard

Q82: The risk-free rate is 4.5 percent.The expected

Q84: The expected return on the market is

Q91: Which of the following is a FALSE

Q94: Use the following three statements to answer

Q95: Which of the following is NOT an

Q100: Which of the following is a TRUE