Multiple Choice

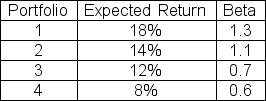

The expected return on the market is 14 percent with a standard deviation of 18 percent and the risk-free rate is 5 percent.Which of the following portfolios are underpriced?

A) 1 and 2 only

B) 1 and 3 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: Which one of the following is NOT

Q79: What are the expected return and standard

Q80: The expected return on the market is

Q82: The risk-free rate is 4.5 percent.The expected

Q86: What is beta?

Q87: A portfolio consists of two securities: a

Q88: A portfolio is composed of $2,000 invested

Q91: Which of the following is a FALSE

Q94: Use the following three statements to answer

Q100: Which of the following is a TRUE