Multiple Choice

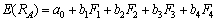

Suppose the returns on Security A are linearly related to four risk factors: F1,F2,F3,and F4.The required rate of return on Security A can be determined as follows:

.The risk-free rate is 4.5 percent.What is the required rate of return of Security A,where b1,b2,b3,and b4 are 0.4,0.8,0.6,and 0.7,respectively,and F1,F2,F3,and F4 are 5 percent,6 percent,10 percent,and 8 percent,respectively?

A) 18.40%

B) 20.60%

C) 22.90%

D) 24.30%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The expected return on the market portfolio

Q4: What is the expected return for a

Q7: Use the following three statements to answer

Q8: Stock A has a standard deviation of

Q9: Which of the following investments would a

Q10: The expected return of Security A is

Q11: In the above question,F<sub>1</sub> F<sub>2</sub><sub>,</sub> and F<sub>3</sub>

Q26: _ is a measure of the risk

Q28: The beta of a portfolio can be

Q90: Assuming the CAPM is valid, _ securities