Multiple Choice

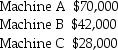

Seeder Inc.made a lump-sum purchase of three pieces of machinery for $130,000 from an unaffiliated company.At the time of acquisition,Seeder paid $5,000 to determine the appraised value of the machinery.The appraisal disclosed the following values:  What cost should be assigned to Machines A,B,and C,respectively?

What cost should be assigned to Machines A,B,and C,respectively?

A) A: $70,000; B: $42,000; C: $28,000

B) A: $67,500; B: $40,500; C: $27,000

C) A: $65,000; B: $39,000; C: $26,000

D) A: $45,000; B: $45,000; C: $45,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Average age of a company's long-term operating

Q12: What are IFRS disclosure requirements for intangible

Q35: Construction costs for fences and driveways are

Q53: An improvement made to a machine increased

Q70: A copyright is an exclusive right to

Q106: Scrap value reduces the depreciable base of

Q147: Presented below are the components related to

Q148: Which of the following is not a

Q151: For income statement purposes,when is depreciation expense

Q166: U.S. GAAP allows a firm to record