Multiple Choice

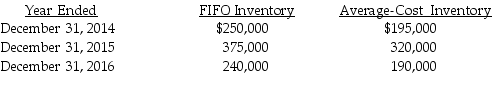

Butler Products decided in 2016 to change inventory methods to more effectively report its results of operations.In the past,management has measured its ending inventories by the average-cost method and they now believe that FIFO is a better representation of its profitability.  Ignoring income tax,which one of the following journal entries correctly records the change in the accounting principle at January 1,2016?

Ignoring income tax,which one of the following journal entries correctly records the change in the accounting principle at January 1,2016?

A) No journal entry need for prospective application of the change in principle.

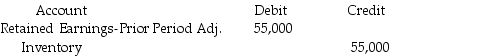

B)

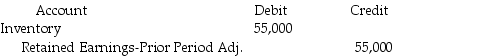

C)

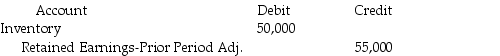

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In a statement of cash flows, the

Q38: When a company makes a change in

Q78: A self-correcting error must self-correct within two

Q102: Which of the following is not a

Q218: Highland Corporation has always used declining-balance depreciation

Q219: Vieta,Inc.'s CFO discovered a program error in

Q220: Retrospective changes require all but which of

Q221: If the first payment on a lease

Q225: On January 1 of the current year,Fields

Q227: Woods,Inc.purchased a new engine for a long-distance