Not Answered

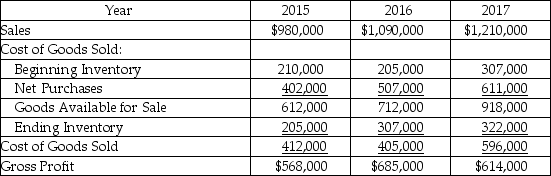

Vieta,Inc.'s CFO discovered a program error in its inventory program in early 2018,when she was making year-end adjustments to the financial statements for 2017.The errors began in 2015.Below is a summary of the sales and cost of goods sold on income statement items for the three years:

Upon further analysis,the CFO determined that each of the years had ending inventory errors.The correct amounts for the years were: 2015,$231,000; 2016,$350,000; and 2017,$474,000.The amounts for 2015 beginning inventory and all purchases are correct as stated.

Upon further analysis,the CFO determined that each of the years had ending inventory errors.The correct amounts for the years were: 2015,$231,000; 2016,$350,000; and 2017,$474,000.The amounts for 2015 beginning inventory and all purchases are correct as stated.

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In a statement of cash flows, the

Q78: A self-correcting error must self-correct within two

Q85: Swanson Corporation is leasing a machine from

Q214: What types of accounts are typically affected

Q215: The three classifications of cash flows are

Q216: Changes in non-current liabilities relate to financing

Q218: Highland Corporation has always used declining-balance depreciation

Q220: Retrospective changes require all but which of

Q221: If the first payment on a lease

Q223: Butler Products decided in 2016 to change