Essay

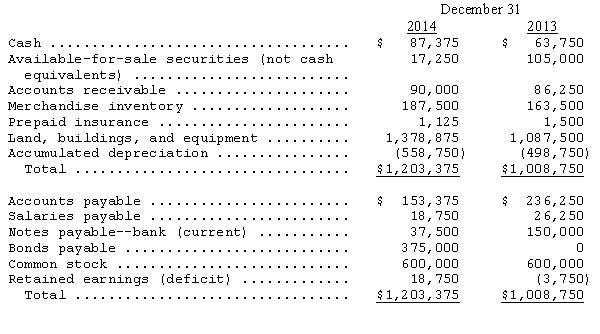

The Dakota Corporation prepared,for 2014 and 2013,the following balance sheet data:

Additional information:

(a)Sold available-for-sale securities (not cash equivalents)costing $87,750 for $90,000.

(b)Equipment costing $18,750 with a book value of $3,750 was sold for $4,500.

(c)Issued 8% bonds payable at par,$375,000.

(d)Purchased new equipment for cash,$310,125.

(e)Paid cash dividends of $22,500 during the year.

(f)Net income for 2014 was $45,000.

(g)Proceeds from the notes payable were used for operating purposes.

Prepare a cash flow statement for Dakota Corporation for 2014,using the indirect method.Calculate the Cash Flow to Net Income and the Cash Flow Adequacy ratios.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Delilah, Inc., presents the following comparative balance

Q8: During 2014,Larson Corp.acquired buildings for $325,000,paying $75,000

Q9: The following information was taken from the

Q12: Net income for Parton Company for 2014

Q16: Thomson Company's income statement for the year

Q17: A gain on the sale of a

Q32: Supplemental disclosures required only when the statement

Q38: Which of the following is not a

Q57: The most likely situation in which reported

Q63: American Corporation purchased a 3-month U.S.Treasury bill.In