Essay

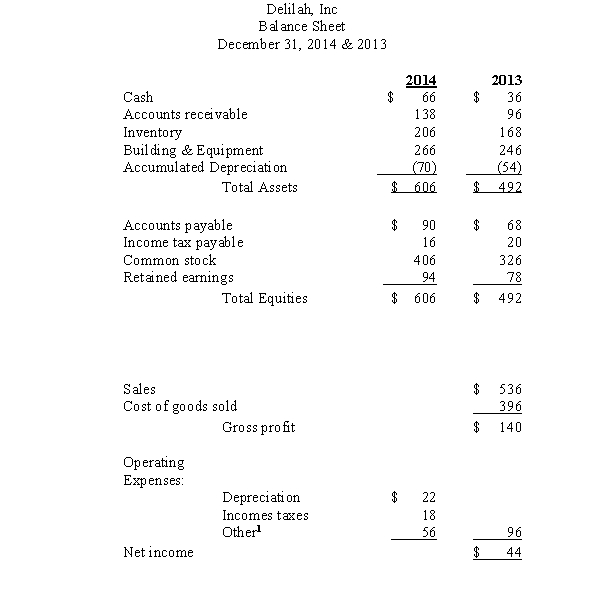

Delilah, Inc., presents the following comparative balance sheets and income statement (all amounts in thousands of dollars):

1Includes interest paid in cash of $23.

1Includes interest paid in cash of $23.

-See information regarding Delilah,Inc.above.The following additional information is provided:

1.Fully depreciated equipment costing $6,000 was abandoned on the first business day of 2014.

2.A building to store materials was acquired for $26,000.

3.A stock dividend of $20,000 was declared and distributed as was a cash dividend of $8,000.

4.Additional stock was sold during 2014 for cash.

Required:

Compute the following:

1.Cash received from customers

2.Cash paid to purchase inventory

3.Cash paid for income taxes

4.Cash from sale of common stock

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A review of the financial records of

Q4: The following data were taken from the

Q5: Waller Corporation had the following account balances

Q8: During 2014,Larson Corp.acquired buildings for $325,000,paying $75,000

Q9: The following information was taken from the

Q11: The Dakota Corporation prepared,for 2014 and 2013,the

Q12: Net income for Parton Company for 2014

Q17: A gain on the sale of a

Q57: The most likely situation in which reported

Q63: American Corporation purchased a 3-month U.S.Treasury bill.In