Not Answered

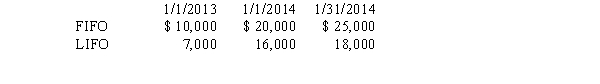

A retailing firm changed from LIFO to FIFO in 2014. Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

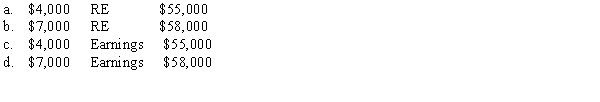

-Using the information above,choose the following:

1.The correct amount in the 2014 entry to record the accounting principle change

2.Whether the entry affects 2014 earnings or is recorded as an adjustment to retained earnings (RE)

3.The 2014 cost of goods sold

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Which of the following does NOT represent

Q15: Which of the following types of errors

Q16: Which of the following concepts or principles

Q28: On January 1,2011,Caravanos Company purchased for $320,000

Q31: Which of the following,if discovered by Somber

Q37: When a firm changed its method of

Q48: Songtress Company bought a machine on January

Q51: Which of the following is not a

Q59: A retailing firm changed from LIFO to

Q76: Which of the following is correct regarding