Short Answer

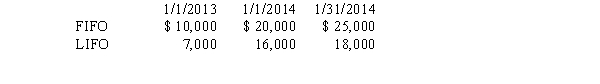

A retailing firm changed from LIFO to FIFO in 2014. Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,in the comparative 2013 and 2014 income statements,what amounts would be shown for cost of goods sold?

Correct Answer:

Verified

Correct Answer:

Verified

Q7: If,at the end of a period,Michaels Company

Q8: Which of the following does NOT represent

Q15: Which of the following types of errors

Q19: Which of the following is NOT a

Q25: Albritton Inc.bought a patent for $900,000 on

Q51: Which of the following is not a

Q54: A retailing firm changed from LIFO to

Q55: Which of the following would NOT be

Q71: Elder Corporation decided to change its depreciation

Q76: Which of the following is correct regarding