Multiple Choice

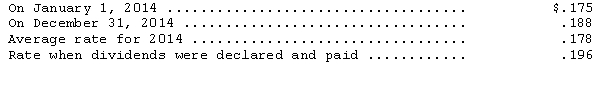

Global Trading Company.converts its foreign subsidiary financial statements using the translation process.The company's Swiss subsidiary reported the following for 2014: revenues and expenses of 13,220,000 and 6,672,000 Swiss francs,respectively,earned or incurred evenly throughout the year,dividends of 2,000,000 Swiss francs were paid during the year.The following exchange rates are available:

Translated net income for 2014 is

A) $891,408.

B) $809,544.

C) $1,283,408.

D) $1,165,544.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Sunrise Technological,Inc.,a U.S.multinational producer of computer hardware,has

Q10: Spirit Leatherworks,Inc.,purchased Brechner Leather Products,a Canadian company,on

Q11: According to FASB ASC Topic 830 (Foreign

Q17: Pilsner Company.converts its foreign subsidiary financial statements

Q24: Complete the following statement by choosing the

Q27: The measurement of deferred tax liabilities and

Q37: Under international accounting standards,cash paid for dividends

Q42: Which of the following is correct regarding

Q48: Which of the following statements most accurately

Q49: Which of the following is true regarding