Essay

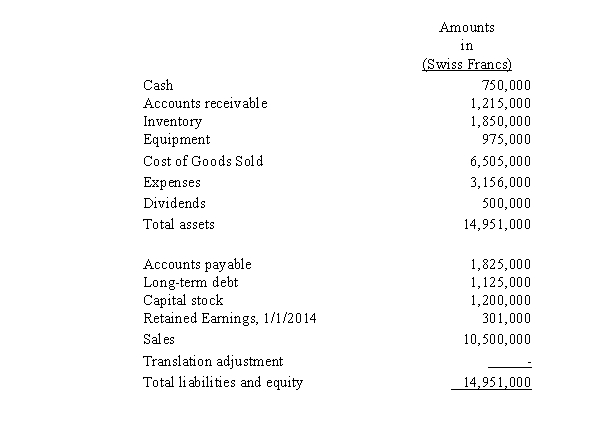

Sunrise Technological,Inc.,a U.S.multinational producer of computer hardware,has subsidiaries located throughout the world.Sunrise Technology purchased Einstein Technology Company,a Swiss producer of computer hardware components,on January 1,2013.Einstein's financial statements are prepared and submitted in Swiss francs to Sunrise's headquarters.Einstein's adjusted trial balance at December 31,2014,is presented below:

Einstein Technology Company

Adjusted Trial Balance

December 31,2014

(in Swiss Francs)

Relevant exchange rates for 2014 and 2013 are as follows:

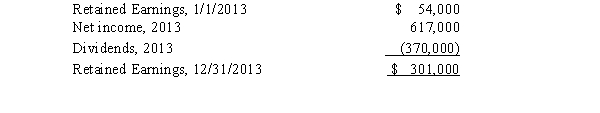

The statement of retained earnings for the year ended December 31,2013,is as follows (in U.S.dollars):

Required:

Prepare a translated statement of income and retained earnings,and a translated statement of financial position in U.S.dollars for Einstein Technology for 2014.

Correct Answer:

Verified

Einstein Technology Co.

Translated Trial...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Translated Trial...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The foreign currency translation adjustments amount is

Q7: Under international accounting standards,the standard for accounting

Q10: Spirit Leatherworks,Inc.,purchased Brechner Leather Products,a Canadian company,on

Q11: According to FASB ASC Topic 830 (Foreign

Q12: Global Trading Company.converts its foreign subsidiary financial

Q19: Which of the following is the current

Q27: The measurement of deferred tax liabilities and

Q29: Current generally accepted accounting principles require that

Q37: Under international accounting standards,cash paid for dividends

Q42: Which of the following is correct regarding