Multiple Choice

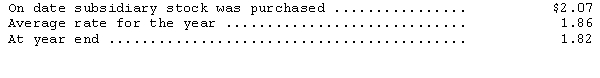

Monty Enterprises,a subsidiary of Kerry Company based in Delaware,reported the following information at the end of its first year of operations (all in British pounds) : assets--483,000; expenses--360,000; liabilities--105,000; capital stock--90,000,revenues--648,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

A) $34,020 debit adjustment

B) $34,020 credit adjustment

C) $11,520 debit adjustment

D) $11,520 credit adjustment

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is the least

Q17: Which of the following is not correct

Q21: Which of the following statements is correct?<br>A)

Q26: Ginza Enterprises,a subsidiary of Universal Enterprises based

Q28: The following financial information is available for

Q32: Corrington Metalworks,Inc.,purchased Scotia Metal Products,a Scotia company,on

Q35: Hibachi,Inc.,purchased Wasabi Manufacturing Company,a Japanese company,on January

Q41: Which of the following is NOT a

Q51: Under international accounting standards,revenue is recognized<br>A) only

Q52: Under international accounting standards regarding depreciation,an entity<br>A)