Essay

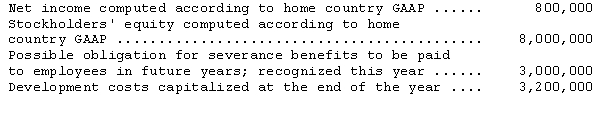

The following financial information is available for Simmer Company,a hypothetical non-U.S.firm with shares listed on a U.S.stock exchange:

If Simmer were following U.S.GAAP,development costs would be expensed when incurred.

According to U.S.GAAP,the possible obligation for severance benefits would not be recognized until it had become probable.

Prepare a reconciliation of Simmer's reported stockholders' equity and net income to the amounts of these items under U.S.GAAP.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is the least

Q17: Which of the following is not correct

Q21: Which of the following statements is correct?<br>A)

Q23: Transit Importing Company.converts its foreign subsidiary financial

Q26: Ginza Enterprises,a subsidiary of Universal Enterprises based

Q30: Which of the following is NOT a

Q30: Monty Enterprises,a subsidiary of Kerry Company based

Q32: Corrington Metalworks,Inc.,purchased Scotia Metal Products,a Scotia company,on

Q41: Which of the following is NOT a

Q51: Under international accounting standards,revenue is recognized<br>A) only